Nuclear fusion, long a distant dream of science fiction, is rapidly approaching commercial viability, sparking significant investor attention. Recent technological advancements, particularly in magnetic confinement and materials science, are paving the way for fusion power plants that could offer a virtually limitless source of clean energy. This shift is attracting substantial private investment, signaling a potential revolution in the global energy landscape.

Key Takeaways

- Technological Advancements: Innovations in high-temperature superconducting magnets are crucial for stabilizing the superheated plasma required for fusion.

- Commercialization Push: Private companies are accelerating development, aiming for grid power in the early 2030s.

- Investor Enthusiasm: Billions are being invested, with tech giants like Google and Microsoft showing interest in future fusion power.

- Regulatory Streamlining: New processes are making it easier to deploy fusion reactors compared to traditional nuclear fission.

- Economic Potential: While initial costs are high, the long-term prospect of cheap, abundant fuel offers significant financial returns.

The Fusion Frontier

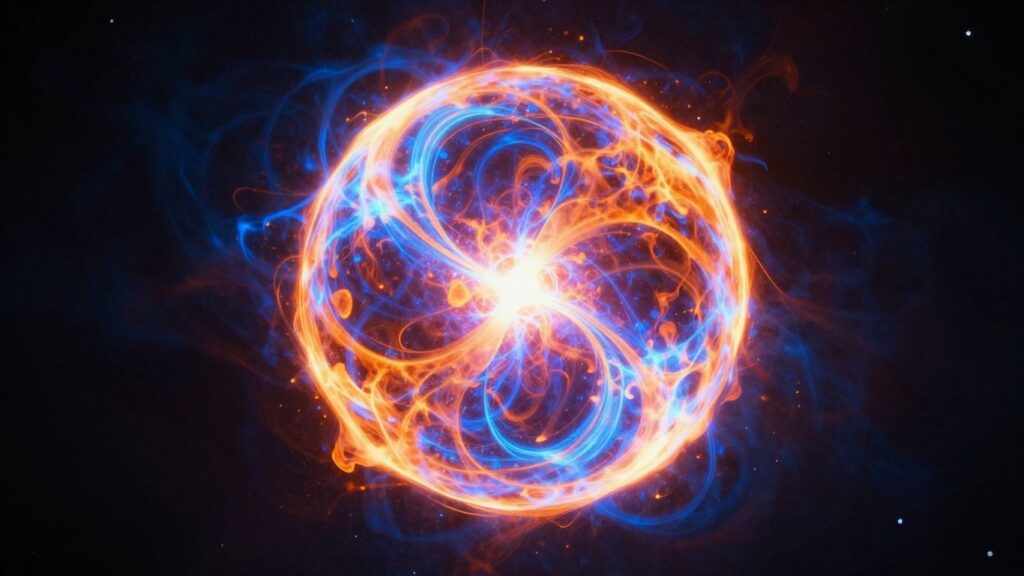

For decades, nuclear fusion has been the elusive promise of clean, abundant energy. The process involves heating isotopes of hydrogen, deuterium and tritium, to extreme temperatures—over 100 million degrees Celsius—to fuse them, releasing immense energy. Companies like Commonwealth Fusion Systems (CFS) are at the forefront, developing tokamak devices that use powerful magnets to contain the superheated plasma. CFS’s key innovation lies in its use of high-temperature superconducting tape to create these magnets, enabling more compact and potentially more efficient fusion reactors.

A New Era of Investment

Unlike the decades of government-led research, the current fusion landscape is increasingly driven by private enterprise. Over 45 private companies globally are now working on commercial fusion, having collectively raised more than $7 billion. CFS has secured over $2 billion, positioning itself as a leader with plans to deliver power to the grid in the early 2030s. This influx of capital is fueled by the immense market potential of the power industry and the growing demand for clean energy solutions, particularly from energy-intensive sectors like artificial intelligence data centers.

Overcoming Hurdles

Despite the optimism, challenges remain. The path to commercial fusion has historically been long and fraught with setbacks, leading to skepticism. However, recent breakthroughs, such as achieving net energy gain in fusion reactions, have shifted perceptions. Furthermore, regulatory bodies are adapting, with new federal processes designed to streamline the deployment of fusion reactors, treating them more like less risky particle accelerators than traditional fission plants. The economic viability, particularly the cost per megawatt hour, is still being determined, but projections suggest it could become highly competitive with existing energy sources.

Geopolitical Implications

The rise of fusion energy also carries significant geopolitical weight. A successful commercialization by any nation could reshape global energy dynamics. Countries like China are actively investing in state-backed fusion initiatives, signaling a potential race for dominance in this transformative technology. As fusion power plants are developed, existing energy infrastructure and regulatory frameworks will need to adapt, potentially leading to costly retrofits or stranded assets if not planned carefully.

Sources

- A Nuclear Fusion Breakthrough May Be Closer Than You Think, Time Magazine.