Cycle-based mid and long-term investment fund focused on nuclear, metals and mining industries

We specialize in strategic diversification and hybrid investment strategies targeting the world’s most dynamic and trending markets. By blending quantitative and qualitative analysis, we identify independent, hard-to-access sources of return across global public markets.

Nuclear Energy: The Next Big Opportunity

Mercury Investments

Nuclear Energy:

Key to AI and

Societal Growth

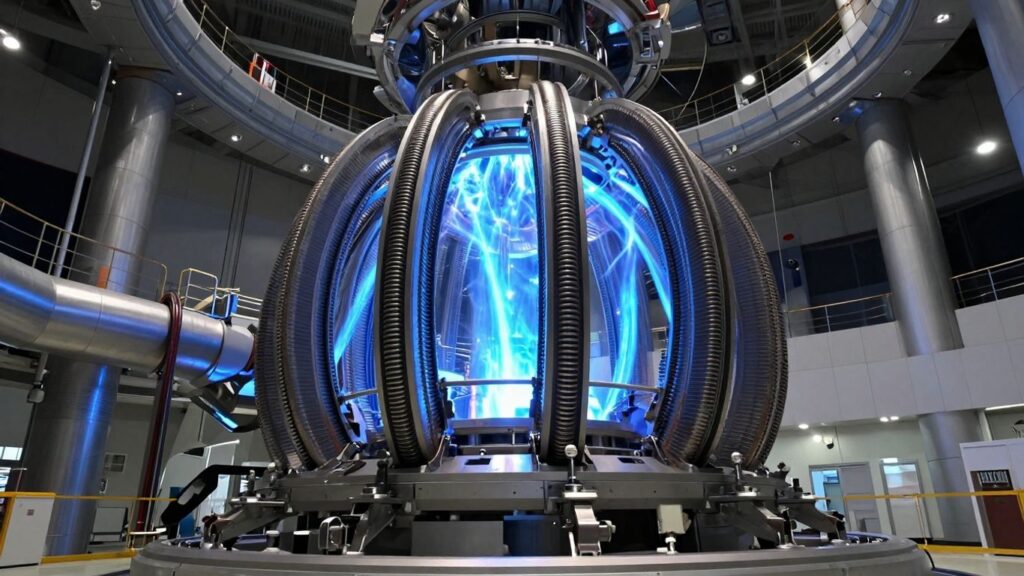

The future of AI and many other industries depends on a reliable and scalable energy supply. As data center power demand is set to grow 100-fold in the next 6 years, the energy needs for AI and related technologies will increase dramatically. Traditional energy sources like wind and solar are already struggling to meet demand, with electricity prices from these sources having tripled since 2019. Nuclear energy, with its high efficiency and scalability, stands out as the most efficient and reliable option to meet this challenge.

While solar and wind power offer renewable alternatives, their output is far less consistent and efficient compared to nuclear. With the rise of Small Modular Reactors (SMRs) and microreactors, nuclear energy is becoming more decentralized, making it suitable for a wider range of applications. Companies like Amazon, Google, and Microsoft are already betting on nuclear energy to power their data centers, while governments, including the U.S., are investing in advanced reactor technologies to secure future energy needs. This trend signals a global shift towards nuclear as a key enabler of technological and industrial growth.

Generative AI, Power Demand, AI Training and Inference

700

600

500

400

300

200

00

2024E

2025E

2026E

2027E

2028E

2029E

2030E

Source: Wells Fargo

Training

Inference

Nuclear Energy:

The Next Big

Opportunity

Nuclear energy is emerging as the next significant trend in the global energy landscape. It is gaining momentum, driven by technological advancements and increasing demand for clean, reliable power sources. Countries worldwide are investing heavily in nuclear infrastructure, and major corporations are incorporating nuclear solutions into their energy strategies. This shift signifies a pivotal moment in the energy sector, presenting new opportunities for investment and innovation.

Nuclear energy is becoming one of the most promising markets for the next decade, driven by a combination of technical and economical factors. Over the past two years, nearly every country has recommitted to nuclear energy, with new reactor under construction and old one being upgraded. The global push for nuclear power is expanding beyond China, with many nations planning to double the number of reactors in operation. This surge in nuclear energy development is reshaping the energy landscape, offering vast potential for growth and investment.

Nuclear

AI Boom

ESG

Cryptocurrency

Fintech VC

FAANG & Tech Stocks

Commodities

Private Equity

U.S. Housing

Dot-Com Bubble

1995

2000

2005

2010

2015

2020

2025

The Billionaire-Backed

Nuclear Energy

Revolution

A growing number of prominent billionaires have made significant investments in nuclear energy, signaling its importance in the global energy landscape. Key figures such as Bill Gates, Warren Buffett, Sam Altman, and Michael Bloomberg have all committed to nuclear energy,seeingit as key to addressing climate challenges. Their investments span from advanced small modular and microreactors to infrastructure projects tied to nuclear energy. This surge reflects their confidence in nuclear energy as an essential tool for the future.

Bill Gates invests in companies developing advanced small modular and microreactors and new types of fuel for them. Warren Buffett supports projects related to the development of nuclear power plants through his companies. Sam Altman, CEO of OpenAI, supports a company developing microreactors for localized energy supply. Meanwhile, Donald Trump and Elon Musk make regular statements about the critical importance of nuclear energy. These individuals wield considerable influence, shaping global energy strategies and making nuclear energy an integral part of the energy transition.

Mercury Investments

Mercury delivers institutional-grade investment management services with a robust, dedicated risk control framework. We have built a cutting-edge, end-to-end trading infrastructure, incorporating machine learning models, fundamental research and systematic risk management tools.

Mercury funds are available to international professional investors and US Accredited Investors. The minimum investment is US $100,000. If you meet the above requirements and are interested in learning more contact our team directly at [email protected]

We use in-house technical and cyclical models to identify the most active stocks from a universe of 500+ publicly traded securities. Asset allocation and market positioning guided by a combination of quantitative tools and fundamental research.

To date we have successfully identified and monetized trends across multiple industries. We have a track record in correctly timing the entries and we know how to identify а trending industry. We act only when the market confirms our hypotheses. No guesswork.

Technological innovation is always the cornerstone of our business. As an investment management firm we employ mathematical and statistical methods in the design and execution of our investment programs. Many years of experience in developing and managing proprietary quantitative trading strategies allows us to apply a highly effective hybrid investing approach. Our advantage is a real synergy of qualitative and quantitative approaches to investing.

To achieve maximum results in market analysis and risk management, we combine the best quantitative models based on rigorous mathematical and statistical approaches with the deep macro and fundamental research. In this way, we combine

the best practices and approaches and eliminate the shortcomings inherent in separate approaches. This is a real synergy.

Discipline, critical analysis, and intense research help us always find the most profitable and reliable deals. We continuously invest in our systems, data, infrastructure and people in our efforts to maximise the alpha we deliver for our clients. We strive to stay at the forefront of advancements in technology and view this as a key competitive advantage. Our overriding objective is excellence. When we say excellence, we mean constant improvement.

Mercury Investments

Our Trusted Partners

Mercury Investments

Mercury Team:

Dream team in the trend

Artjoms

Krizanovskis

Nuclear Evangelist & Business Development

Investor relations. Institutional partnerships. Energy transition and nuclear advocacy. Business strategy.

A seasoned Investor Relations professional with a proven track record leading Seed, Series A, and Series B funding rounds totaling over USD 100 million.

With more than 15 years’ experience in the e-commerce sector, Artjoms has cultivated a strong international network spanning fintech companies, venture capital funds, and strategic industry partners.

A self-driven serial entrepreneur, he has founded and successfully exited multiple IT start-ups with a combined exit value exceeding USD 70 million.

His career reflects a consistent focus on scaling innovative businesses, securing strategic investment, and building long-term value for stakeholders.

Walter

Reich

Member of the Board

Veteran Financial Executive. Executive at $900m Fund. Previously at KPMG.

Walter Reich is a chartered financial accountant and has worked for over 25 years in the fund industry.

He has resided in the British Virgin Islands since January 2006 after having worked in London for 6 years in a variety of capacities for the Lionhart hedge fund group with USD 900 million under management including CFO, Compliance Officer, Marketing Coordinator and Member of the Management Committee.

Previously held positions at KPMG Canada and BVI, and Citco Fund Services (BVI) Ltd.

Igors

Plahins

Fundamental Research & Business Development

Fundamental analysis. Fund structuring. Investor relations. Formerly with Morgan Stanley and EY.

Igors is a finance, strategy, and go-to-market expert with over a decade of investment management experience across multiple asset classes.

He has served as a executive and strategy advisor on more than 10 high-profile projects for companies including Vodafone, MasterCard, Kraft Foods, GSMA, Carlyle Group, HG Capital, Tesco Group, and Digicel.

His career includes roles in Morgan Stanley’s M&A division and EY’s strategy team in London, as well as senior positions in high-growth technology companies such as Clearmatics. He holds a BSc in Philosophy, Politics and Economics from the University of Warwick and an MSc in Accounting and Finance from the London School of Economics.

Sjoerd

Koster

Member of the Board

Senior Bank Executive. Previously at TMF Group and ABN AMRO. BVI Government adviser.

A financial‑services veteran with more than 25 years’ experience.

He spent 13 years as General Manager–Client Business at VP Bank (BVI), where he oversaw client strategy, investment advisory and financing, while leading regulatory compliance and risk management for the Swiss‑listed bank’s subsidiary Bank.

Earlier, he held senior positions at TMF Group and ABN AMRO Bank.

A former President of the BVI Bank Association and Deputy Chairman of the Association of Registered Agents, he has advised the BVI Government on fintech and economic development and currently serves as a member of the BVI Financial Services Complaints Commission.

Alexander

Tatarchenko

Global Macro & Quantitative Research

Strategy development. Quantitative research. Risk management. Cross-asset analytics.

Over 15 years of experience working in financial markets as an analyst and trader, utilizing all available financial instruments: stocks, bonds, futures, options, and cryptocurrencies.

8 years of experience as the founder and manager of a cryptocurrency family office. Developed algorithmic, fully automated AI-based trading systems.

Higher education in economics, information security and financial risk management.

Valerii

Voronin

Technology & Analytics

Quantitative model R&D. System architecture and data infrastructure. Applied mathematics.

Over 30 years of experience in designing and operating high-load IT systems, multiplayer game servers, recognition systems, and low-latency trading systems.

CTO and co-founder of numerous tech projects. The latest successful venture is the market-making company SkynetTrading Ltd.

Mathematician-engineer with additional education in economics.

Carine

Tawil

Account Manager

Key Account Manager. Client Onboarding Specialist.

Pavel

Brovchenko

Data Science & Analytics

Data scientist. Quantitative Models Research and Development.

Over 25 years of experience as a lead developer with deep expertise in financial technologies, complex software architecture, and scalable high-performance systems. Specializing in algorithmic trading solutions and low-latency infrastructure.

Extensive background in building fintech platforms, trading systems, and mission-critical IT products. Proven ability to lead technical teams and deliver innovation under demanding business requirements.

Strong foundation in computer science, with a focus on practical applications in trading, automation, and system optimization.

Jean-Marc

Bonnefous

Advisory Committee

20 Years in Fund Management. Ex-Global Head of Commodity Derivatives at BNP Paribas.

Founding and Managing Partner of Tellurian Capital Management LLP since 2006, a London-based investment firm focused on commodity and next-generation digital assets strategies.

Jean-Marc has extensive experience managing institutional and private investments and launching new ventures. Formerly an investment banker and Global Head of Commodity Derivatives at BNP Paribas in New York and London, he built and led the bank’s global commodity derivatives business across Europe, the US, and Asia, playing a key role in the development of structured derivatives in oil, natural gas, and base metals in the 1990s.

Since 2014, Jean-Marc has also been an Adjunct Professor of Finance at IE Business School in Madrid, Spain.

Per

Jander

Advisory Committee

Director at WMC, a Technical Advisor to Sprott Physical Uranium Trust. Ex-Cameco Corporation.

A 20-year veteran of the energy sector. He spent over a decade in uranium sales and trading with Cameco Corporation and previously worked in nuclear power plant fleet management, investment planning, and new-build programs at utilities in Sweden and Switzerland.

His earlier roles include policy and trade work at the World Nuclear Association in London and energy trading across various European markets.

At WMC, he leads advisory work with Sprott and drives commercial engagement with the investment community and key customers in Europe and Asia. Per holds an MSc in Industrial Engineering and Management from Linköping Institute of Technology, Sweden.

Kenneth

Judge

Advisory Committee

M&A and Securities Lawyer. Independent Director at Standard Uranium (TSX-V).

Ken has been a founder, chairman, CEO or Non-Executive Director of more than 30 companies operating in many different countries and across various sectors including the exploration and production of natural resources (including Gold and Silver, Uranium, Diamonds and Titanium minerals), oil & gas and “big data”.

Mr. Judge has extensive experience in evaluating and executing public and private “cross border” merger and acquisition opportunities and the public listing and regulatory compliance of companies listed on the TSX, TSX-V, Nasdaq, LSE, ASX, HKSE, Philippines and Peru stock exchanges.

Ken has undergraduate and post-graduate degrees in law and finance from the University of Western Australia and is an independent director at Standard Uranium (TSX-V).

Mercury Investments

Investment

Decision Funnel

Detailed due-diligence on over 500+ publicity traded securities. Priority is given to instruments that have already passed the primary accumulation phase in the new cycle and are ready to move into the active revaluation stage.

We have multiple quantitative tools and techniques to work with the market opportunity, including cycles analysis, market dynamics, trend analysis and AI models.

We combine quantitative tools with deep fundamental research.

The portfolio composition will always adapt

to the current market phase.

“Safety first” — this is our first rule.

No single position can result in critical losses.

Risk management & investment committee final approval.

At different stages of the revaluation cycle, select instruments will have an advantage. The portfolio will be rebalanced over time between spot metals, small and established producers.

Universe of 500+ securities

Quantitavie tools

Fundamental research

Risk management

Portfolio

Mercury Investments

Fund News:

Mercury.Investments

Welcomes Per Jander to its Advisory Committee

Monaco, August 28, 2025

Mercury.Investments, manager of the Nuclear Renaissance Investment Fund, is proud to announce that Per Jander has joined its Advisory Committee, bringing unparalleled expertise in the nuclear energy sector to support the fund’s mission of capturing the ongoing global revaluation cycle in nuclear energy, metals, and mining.

Mercury.Investments, manager of the Nuclear Renaissance Investment Fund, is proud to announce that Per Jander has joined its Advisory Committee, bringing unparalleled expertise in the nuclear energy sector to support the fund’s mission of capturing the ongoing global revaluation cycle in nuclear energy, metals, and mining.

Mr. Jander is a seasoned nuclear industry professional with a distinguished career spanning investment advisory, corporate development, and uranium market strategy. He currently serves as Director at WMC, a leading intermediary in the global nuclear fuel markets and Technical Advisor to Sprott Physical Uranium Trust, the world’s leading physical uranium investment vehicle. Earlier in his career, he held senior positions at Cameco Corporation, one of the largest global uranium producers, where he was instrumental in advancing market strategy and uranium trading activities.

In his new role with Mercury.Investments, Mr. Jander will provide strategic guidance on global uranium supply-demand dynamics, nuclear fuel markets, and investment opportunities tied to the rapidly expanding adoption of nuclear energy worldwide. His insights will strengthen the fund’s positioning in a sector that is witnessing record levels of institutional and governmental support.

“Per’s addition to our Advisory Committee marks a significant milestone for Mercury.Investments,” said Artjoms Krizanovskis, Director at Mercury.Investments. “His deep expertise and global network in uranium markets will be invaluable as we continue to identify, evaluate, and capture opportunities across the nuclear energy value chain.”

The Nuclear Renaissance Investment Fund focuses on cycle-based mid- and long-term opportunities in nuclear, metals, and mining. Guided by its proprietary technical and cyclical models, the fund invests across uranium mining, enrichment, nuclear technology, and supporting industries, with diversification into precious and industrial metals.

With Mr. Jander’s appointment, Mercury.Investments strengthens its global advisory board, which includes seasoned executives from BNP Paribas, Standard Uranium, and Sprott-affiliated advisory firms.

For more information, please contact:

mercury.investments

![[Bill Gates] and nuclear power plant fueling AI and homes.](https://mercury.investments/wp-content/uploads/2025/12/thumbnail-22-1024x576.jpeg)