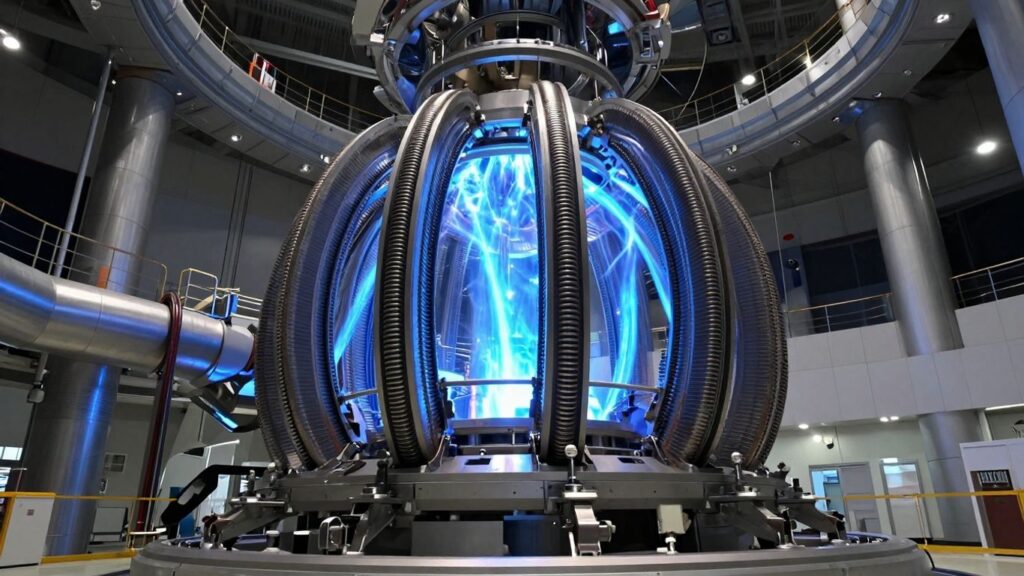

The nuclear energy sector is experiencing a significant revival, attracting substantial investor interest. Driven by the escalating power demands of artificial intelligence and data centers, alongside supportive government policies, global investment in nuclear power has seen a dramatic increase. This resurgence positions nuclear energy as a critical component in meeting future energy needs.

Key Takeaways

- Nuclear energy is undergoing a renaissance, fueled by AI’s immense power requirements and favorable government policies.

- Investment opportunities span uranium mining, utility companies, and innovative Small Modular Reactors (SMRs).

- Major tech firms are securing nuclear power agreements to support their AI ambitions.

The AI-Driven Demand

The burgeoning field of artificial intelligence and the exponential growth of data centers are placing unprecedented demands on electricity grids. Data centers, which consumed approximately 4.4% of U.S. electricity in 2023, are projected to increase their consumption to around 12% by 2028. This surge in demand necessitates reliable, 24/7 power sources, making nuclear energy an attractive solution. Leading technology companies, including Meta, Amazon, Alphabet, and Microsoft, are actively entering into nuclear power purchase agreements to secure clean and consistent energy for their operations.

Investment Avenues

Investors can gain exposure to the revitalized nuclear energy sector through several avenues:

- Uranium Miners: Companies like Cameco Corporation are central to the nuclear fuel supply chain. Their performance is closely tied to uranium prices and demand.

- Utilities: Established utility companies, such as Constellation Energy Corporation, which operate nuclear power plants, offer a more stable investment. Their ability to benefit from rising electricity prices and demand is a key factor.

- Small Modular Reactors (SMRs): This next generation of nuclear technology promises faster deployment and lower costs. Companies like NuScale Power Corporation and Oklo Inc. are at the forefront of SMR development, representing a higher-risk, higher-reward investment.

- Exchange-Traded Funds (ETFs): For diversified exposure, ETFs such as the Global X Uranium ETF (URA) and Sprott Uranium Miners ETF (URNM) offer a basket of companies involved in uranium production, manufacturing, and services.

Challenges and Outlook

Despite the positive momentum, the nuclear energy sector faces challenges. These include construction and development risks, a concentrated supply chain for uranium, and the potential for shifting political support. However, the fundamental drivers of increased energy demand, particularly from AI, and the global push for low-carbon energy sources suggest a strong future for nuclear power. The development of SMRs is also poised to make nuclear energy more accessible and cost-effective, further bolstering its prospects.

Sources

- How To Invest in Nuclear Energy. What You Need to Know, Investopedia.

- Want to invest in nuclear energy? DBS cites opportunities in mining, utilities stocks, The Business Times.

- Here’s A List Of Tickers To Watch, Yahoo Finance.