NuScale Power Holdings’ stock experienced a significant surge following a landmark agreement with the Tennessee Valley Authority (TVA) for its small modular reactor (SMR) technology. This deal, representing the largest SMR power commitment in U.S. history, positions NuScale at the forefront of the nation’s clean energy transition and has garnered considerable attention from investors and industry leaders alike.

Key Takeaways

- NuScale’s stock price jumped significantly after the TVA announced a historic agreement to deploy its SMR technology.

- The deal is the largest SMR commitment in U.S. history, potentially boosting NuScale’s market position.

- Wall Street analysts have responded positively, with several firms raising price targets and ratings for NuScale.

- SMRs offer advantages over traditional nuclear plants, including factory-built modularity and lower costs.

- NuScale’s technology aligns with ESG goals, providing low-carbon energy and grid stability.

Historic Nuclear Deal Drives Stock Rally

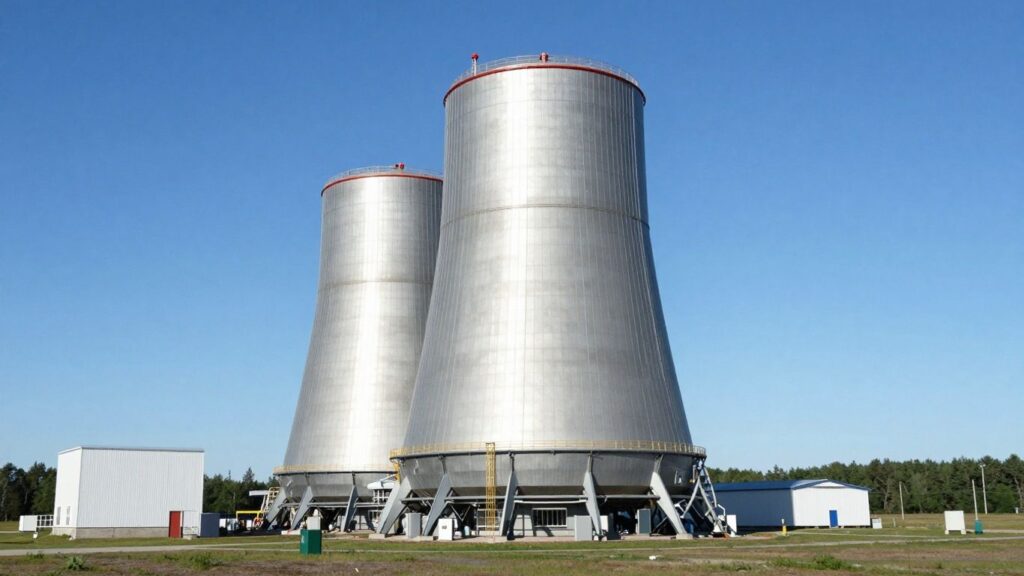

NuScale’s share price saw a notable increase, with reports indicating a rise of over 25% following the late August announcement of the TVA agreement. As of early September, the stock continued its upward trend, reflecting strong investor confidence. This agreement marks a pivotal moment for nuclear energy in the United States, with the TVA planning to build the nation’s first SMR nuclear power station using NuScale’s U.S. NRC-approved technology.

Wall Street Backs Nuclear’s Next Chapter

Financial analysts have reacted favorably to the news, with Bank of America raising its price target for NuScale, citing the TVA agreement as validation of SMRs’ commercial viability. Other firms, including Wells Fargo, have also upgraded their ratings, anticipating growth in construction contracts and licensing revenue. The projected capacity of the TVA project is reportedly more than five times the size of all existing global SMR projects combined.

SMRs and ESG: A Green Power Game-Changer

NuScale’s SMRs are designed to provide low-carbon energy, aiding utilities in phasing out coal and gas plants to meet net-zero targets. Key advantages of SMRs include zero CO₂ emissions at the point of generation, efficient land use compared to renewables, and the ability to deliver steady, 24/7 power, enhancing grid stability. These attributes make them an attractive option for ESG-focused portfolios.

Scaling SMRs: The Outlook for Clean Nuclear Power

The TVA deal is seen as a potential precursor to broader SMR adoption in the U.S. and internationally. Factors such as NuScale’s 2024 NRC approval for its SMR design and growing global interest from countries like Poland, the U.K., and Canada are expected to drive future growth. SMRs are also viewed as complementary to renewable energy sources like solar and wind, helping to balance the grid.

NuScale’s Net-Zero Promise for Industry and Grid

NuScale’s advanced light-water reactors are the only SMR design certified in the U.S., offering a path for utilities to replace fossil fuel plants with reliable, carbon-free baseload power. The technology’s low lifecycle carbon footprint, comparable to renewables, and its potential for multi-sector decarbonization, including industrial heat and hydrogen production, further enhance its appeal. The company’s involvement in international projects, such as a potential deal in Romania, also highlights its global decarbonization alignment.

Challenges and What to Watch

Despite the positive momentum, challenges remain. The first TVA plants are not expected to be operational until the late 2020s, and SMR projects still require significant upfront investment. NuScale must also demonstrate its ability to scale operations, build a robust supply chain, and master serial manufacturing to reduce costs. Public perception and regulatory hurdles also present ongoing considerations for the nuclear industry.

Investors will be closely monitoring key milestones, including final investment decisions from TVA in 2026, NuScale’s success in delivering subsequent units to achieve economies of scale, and its expansion into new international markets.

Sources

- NuScale Power Stock Surges After U.S. Biggest SMR Nuclear Deal, CarbonCredits.com.